Notes from the edge of civilization: January 19, 2025

Blundering banks better buckle up; smell ya later, Janet; not easy being green; one buckeroo you don't want to miss.

The incoming administration has almost everyone and everything on a sugar high — and rightly so. It’s the dawn of a new day in America.

But the crash that comes after a sugar high is always profound. In the case of America’s big banks, the potential for crash is both literal and figurative — they’re ticking time bombs, actually.

Yet, on the surface, the banks are pumping out news that seems worthy of celebration: JPMorgan Chase, Goldman Sachs, Citigroup, and Wells Fargo all reported blowout earnings. JPMorgan’s profits shot up 50%(!), Goldman’s more than doubled, and Citi flipped a $3 billion loss into a gain. Wells Fargo got a cool $1.5 billion boost.

Meanwhile, Bank of America just revealed $112 billion in unrealized bond losses —57% of their tangible common equity. This isn't just bad; it’s catastrophic. Still, the bank claims their “balance sheet remained strong.”

So what’s actually going on?

Dealmaking fever: Wall Street’s optimism over Trump-era deregulation has private equity firms throwing money at banks like it’s Monopoly cash.

Interest rate mayhem: High rates on credit cards, mortgages, and loans have been a cash cow for banks, but rising bond yields have slammed the value of their portfolios, leaving institutions like Bank of America gasping for air.

The FDIC estimates the entire US banking sector is now drowning in nearly half a trillion dollars of unrealized losses. Some banks are weathering the storm but others are praying for rate cuts that would magically fix their books without anyone noticing the disaster.

The choices ahead:

Print more money (quantitative easing) and spark more inflation.

Get fiscal discipline — cut spending, overhaul regulations, and embrace real economic growth.

Let’s be honest: option two might as well be a unicorn. So buckle up for even more inflation and stash your savings in real assets. The banks are sweating bullets, and the Fed is all out of magic tricks.

Talk about ending your government stint with a bang! The computer of our soon-to-be-former Secretary of the Treasury, Janet Yellen, was “infiltrated” (um, hacked is the proper term) and “unclassified files” (yeah, right) were accessed by the Chinese, according to Bloomberg. So there’s that final salvo, which is the initial stun grenade to set the mood.

But, on her way out the door, compromised IT just wasn’t enough. Instead, Yellen took the opportunity to light a paper bag filled with doo-doo (figuratively speaking, of course) on the doorstep of the Treasury building with this little tidbit.

That’s right. On the first day of the Trump administration, the new Treasury Secretary — Scott Bessent — will have to hit the ground running to prevent the US from defaulting on its obligations, as well as stamp out that burning bag! Hard to believe we’re still only in January.

On the other side of the country, another disaster is unfolding.

As the smoke clears from devastating Los Angeles wildfires, efforts to clean up the affected areas are being complicated by burnt-out electric and hybrid vehicles and home-battery storage systems.

The wildfires are exposing what happens when green tech crashes headfirst into climate catastrophe. There were nearly half a million Teslas in the Los Angeles area — and that doesn’t even count EVs from other car makers.

Fires in lithium batteries are notoriously hard to put out and require large amounts of water. Governor Gavin Newsom, the guy who has been pushing for all-zero-emission vehicles by 2035, might be rethinking his timeline. Others are left wondering whether California’s eco-dream is just a wildfire accelerant in disguise.

Anyway you slice it, green dreams have turned into toxic nightmares and we’re only just scratching the surface at this point. Think of all the toxic materials and electronics you have in your home. Now think about thousands of homes with the same (or more) that have just gone up in smoke. Yeah, it’s bad.

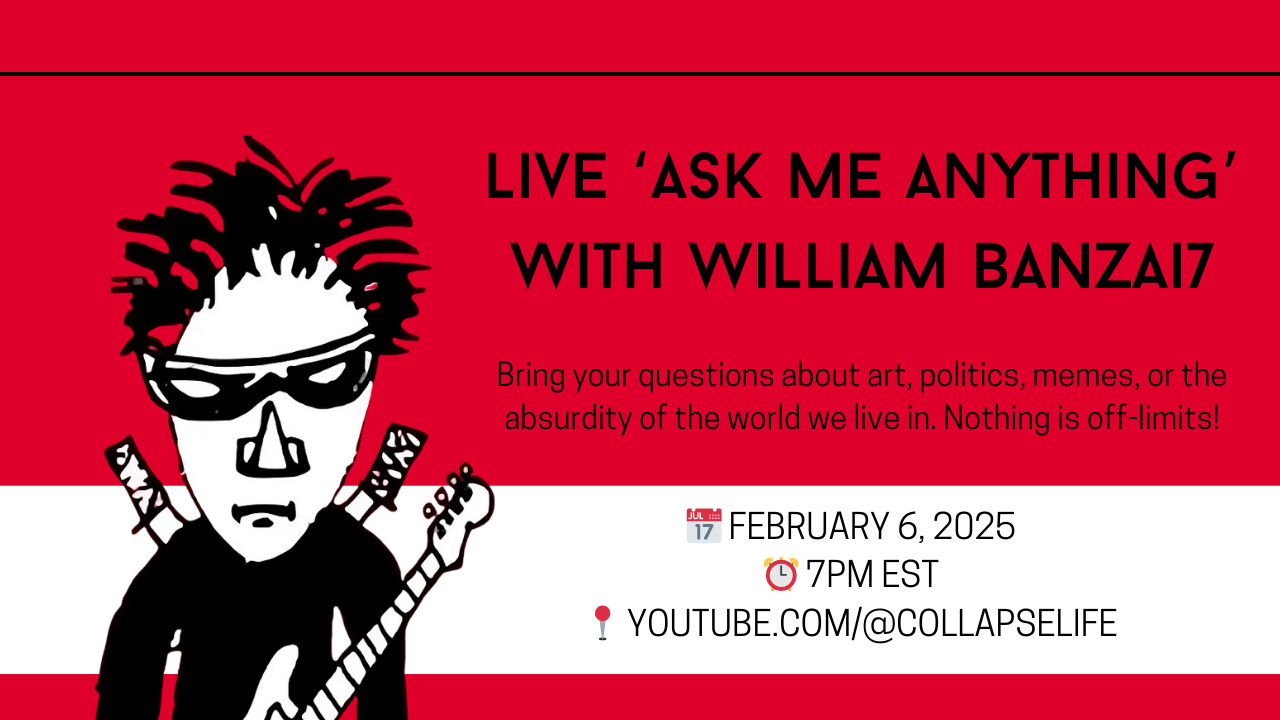

Please join us for our upcoming event: Live ‘ASK Me Anything’ with William Banzai7

Join Collapse Life host Zahra Sethna for our inaugural live and in-person webinar featuring none other than the sage of satire, the prince of Photoshop, the wizard of wit — William Banzai7.

WB7 will dish out his razor-sharp insights on the latest global madness, tackle your burning questions, and interact in his signature style: irreverent, hilarious, and unfiltered. This is your chance to see the man behind the memes like never before.

Mark your calendar, clear your schedule, and prepare to laugh, think, and maybe cry (just a little) at the absurdity of it all. Don’t miss this epic kickoff to a series that promises to keep you on the edge of civilization.

📅 Date: February 6, 2025

⏰ Time: 7 PM EST

📍 Where: youtube.com/@collapselife

Craziness abounds, its going to be a wild ride and thats only this week.

First and foremost, pray for your families and our nation and for sound leadership. Second, take charge of your own household. Limit your spending mainly to necessities(and look for bargains). Of course you can treat yourself occasionally but avoid any unnecessary BIG expenditures and instead save that money. In a bank?? Good question being as banks in general are not exactly on solid ground these days but may still be a necessary evil. I certainly would consider material gold and silver. I don't know much about crypto so I can't make any educated recommendations. The bottom line is that even though our government is NOT engaging in fiscal responsibility, doesn't mean we can't protect ourselves by doing so.