Honey, I shrunk the house!

Homes are shrinking. Is it any surprise that, despite this, buyers are paying more? Then there's Canada, where buying a new home could lock you into renting for life-saving essentials, such as heat!

The North American real estate market is starting to reflect a trend that many consumers might recognize from the grocery store: shrinkflation.

Just as your favorite bag of chips has subtly reduced in size while the price remains the same — or even increases — homes across North America are getting smaller, but costs are rising. And, just as some car manufacturers are offering on-demand functions like heated seats or driving and parking assistance for a monthly fee, some house builders are forcing homeowners into monthly rental contracts for standard features.

For years, the narrative around real estate has been centered on the ideas of “mega mansions” and "bigger is better.” However, these ideals are increasingly running up against some harsh economic realities.

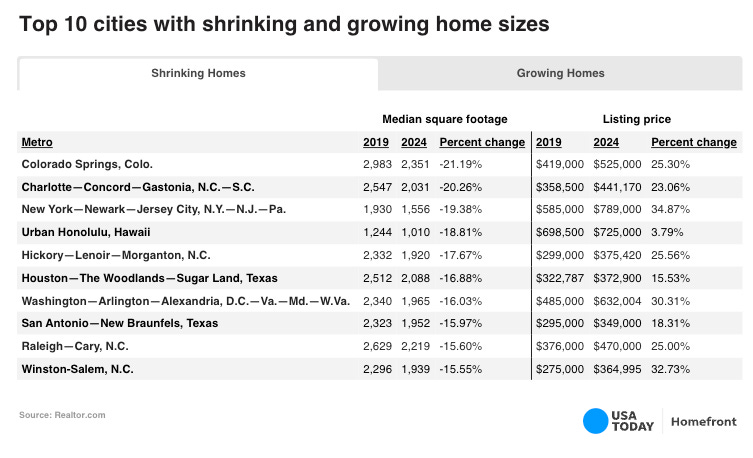

The average size of a new home in the US is now significantly lower than it was just a decade ago. USA Today reports that since 2019, the median house has shrunk by 128 square feet but increased in price by $125,000.

This isn’t just a trend in urban areas where space is limited and prices are at a premium — it's happening in the suburbs and rural areas as well. The reasons are complex, involving everything from rising construction costs and supply chain issues to more insidious economic pressures.

Developers, caught between higher material costs and the need to maintain profit margins, are cutting corners — literally.

Homes now have fewer hallways, in a cost-saving move to decrease the number of interior walls, according to a July 2024 report from the New Home Trends Institute (NHTI). Most new homes will now also feature ‘flex spaces’ designed to be highly functional and fill every available nook and cranny with ‘purpose.’ In other words, a 5x5 storage closet or that crawl space below your staircase is now being billed as a ‘work from home’ area or ‘pet space.’

Yes, you too can join the Office Space cubicle set, right in your own home.

Entry-level homes targeted at first-time buyers or those with limited budgets are seeing significant tradeoffs in features and finishes. For example, smaller eat-in kitchens and reduced outdoor spaces are becoming the norm. Same with storage space; this is a critical feature for growing families and it’s essentially disappearing.

Empty nesters looking to downsize are far more affluent and don’t face the same constraints. For these folks, not only do homes retain or even expand storage spaces, but these buyers are less willing to compromise on comfort. The divergence reflects a broader trend: different segments of the market are experiencing shrinkflation in distinct ways, with entry-level buyers bearing the brunt of trade-offs.

Fewer square feet per home means fewer materials and labor hours, allowing builders to present a seemingly more "affordable product.” However, not unlike the same size box of Oreos containing fewer cookies, affordability in these new homes is an illusion because, as the size of the house decreases, the price per square foot has not been constant; it’s been steadily increasing. The result is buyers forking over larger sums for smaller spaces.

In Canada, an even more dystopian trend is unfolding. Not only are homes shrinking, but they are also being sold without essential features like furnaces and water heaters, forcing buyers into a lifetime of renting basic amenities. In this alarming twist, reported by Jared Brock on his

Substack, developers require buyers to sign rental contracts for basic systems like heating, air conditioning, and hot water as part of their home “purchase.”So, even after paying an exorbitant purchase price — up to $850,000 — homeowners are burdened with additional costs, paying hundreds of dollars annually just to stay warm. Opting out of rentals from the builders is possible, but then the sticker price of your home increases, upwards of $22,000 in some cases, making the true cost of purchase far higher than the one advertised.

It begs the question: why are buyers agreeing to pay more for less? Partly, it’s the psychological game of pricing. A smaller home with modern amenities can still be marketed as "luxury" or "efficient," appealing to buyers who may otherwise be priced out of larger properties but still want to believe they're getting something of value.

Still, deception is powerful. Shrinking home size doesn’t always equate to a decrease in the cost of living. Utility bills, homeowners’ association fees, maintenance costs, and property taxes are not necessarily scaled down with square footage. Buyers end up paying more over time, even as they compromise on space and potentially, quality of life. Home ownership itself is becoming elusive, with growing throngs pushed into perpetual rentership — of homes and everything that fills and fuels them.

At a macro level, shrinkflation in real estate is a reflection of broader economic issues. Stagnant wages, inflation, and a speculative real estate market have conspired to make housing less accessible for many. The mainstream narrative might suggest these trends are temporary or part of a natural economic cycle, but market watchers are noting something deeper at play.

In truth, the shrinking size of homes is partly symbolic of the shrinking middle class — fewer people can afford the spacious, single-family homes that once defined American prosperity. Instead, they’re forced into smaller, more expensive spaces, all while being told that this is the new normal. This is also playing out in the restaurant space, with a distinct bifurcation between affordable entry-level and high-end dining options — meanwhile, the middle ground is disappearing.

This is what a dying monetary system looks like — less for more. The sad part is, things are likely to get worse. Smart consumers will recognize this and are planning accordingly. For everyone else, the key is to try making informed decisions that reduce or eliminate financial precarity altogether, which by our own admission, is easier said than done.

There are a host of problems coming together in a "perfect storm."

One part of it is the failure of centralized planning. The higher the density of housing, the higher the tax revenues. Stricter building codes and environmental regulations drive costs up as well. Most jurisdictions don't even develop their own regulations. They just pay for generic building regulations and ordinances.

For builders, there is a lot more profit in building more expensive homes on any given property. There is little incentive to build anything to be more affordable. On top of that, to meet increased costs required by building regulations, they cut costs elsewhere. Also, as two income families have become the norm, there is a huge incentive to maximize those previously untapped second incomes.

Go back a few years, homes were much smaller. You would find three bedroom homes around 1000 sq. ft. with one bathroom that were within reach of a single income family. Most buyers wouldn't even consider something of that type now.

My sister, 63 yrs old, opted to sell her 2500 sqft home and purchase a 399 sqft tiny home! She absolutely loves it. She got rid of most of her possessions she didn’t really love, gave a lot to her 2 daughters who were starting their own homes and rented a tiny storage unit for things she couldn’t bear to get rid of. I thought it would be claustrophobic, but it’s not and she points out that she basically lived in her kitchen and living room in her big house and just used her bedroom for sleeping. She loves living in a tiny house community and loves being free of clutter. I guess there’s a lot to be said for downsizing, at least for some of us.