Broke now, poor later

Apps like Afterpay and Klarna are driving young Americans deeper into debt and fueling their financial nihilism.

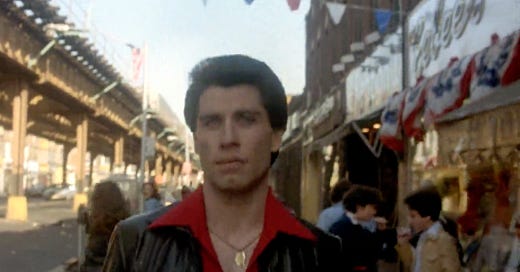

For the nostalgic film buff, a few things stand out from Saturday Night Fever’s iconic opening scene: the Bee Gees music, the Brooklyn Bridge, the rattling subway cars, John Travolta eating pizza. But you may have forgotten that sequence where cash-strapped but image-conscious Tony Manero — Travolta’s character — decides to put $5 down on a blue silk shirt priced at $27.50.

Throughout the 20th century, layaway programs allowed consumers to pay for items in installments rather than in a lump sum. People with limited disposable income like Manero were able to acquire aspirational items, but had to endure delayed gratification. Sure you could have anything you needed or wanted… just as soon as you scraped together the bread.

Until the mid-1980s, these schemes were pervasive at the classic, now-moribund, malls that dotted urban and suburban America. Then credit cards went mainstream which, starting for Generation X, unleashed a whole new era of monetary freedom. Unlike Manero, pretty much anyone could buy a silk shirt without having to balance a checkbook or dig through the couch for errant loose change. Plastic was where it was at.

If that Saturday Night Fever scene was updated for the 2020s, Manero’s face would likely be lit by the glow of his iPhone. He’d be scrolling through ________ (fill in the blank for your favorite artisanal silk shirt vendor) and his purchase would be made from organic silk from certified fair-trade silkworms. With the tap of his finger, the shirt would sit in an online cart, he’d commence checkout, and pay as little as possible up front (as many Gen Zers are apt to do). The remainder of the purchase cost would be conveniently delayed thanks to apps like Afterpay and Klarna.

That’s called Buy Now, Pay Later — or BNPL.

BNPL turns layaway on its head, allowing for instant rather than delayed gratification and breaking up a lump sum into fixed payments over time. If that sounds like fiscal insanity, it is. Afterpay, Klarna, and other such services are integrated into most online shopping sites, offering a staggered approach to paying for everything from luxury fashion to Uber Eats.

Why pay $6 for your Chick-fil-A nuggets when you can just pay $1.50 now and worry about the rest later? That pair of $490 Valentino flip flops feels so much more affordable broken down into four interest-free payments of $122.50, doesn’t it?

Global sales using BNPL were estimated at $93 billion in 2020 and then took off to $334 billion in 2024. Forecasters say they could exceed $687 billion by 2028, according to a recent report from Juniper Research.

BNPL options are specifically marketed to younger consumers, promising “inclusion” for shoppers in underserved communities or for the unbanked. It’s fiscal trickery that encourages people to dream big, and pay small. But (this will come as no surprise) it’s driving young Americans deeper and deeper into debt. In fact, many consumers say BNPL actually encourages them to overspend.

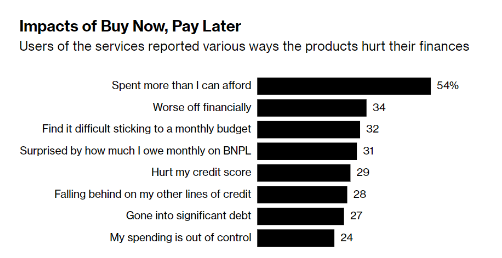

In a Bloomberg-Harris poll conducted in April 2024, more than half of respondents who use BNPL said the services allowed them to purchase more than they could afford. Worryingly, nearly a quarter agreed that their BNPL spending was “out of control.” One third said they were surprised by how much they owed monthly on BNPL. Almost 1 in 3 said they were delinquent on other debt because of spending on the platforms.

A particularly frightening finding is that almost half (48%) of those using BNPL say they’ve started, or have considered, using it to pay bills or buy essential items like gas and groceries.

That deserves repeating, in case the fiscal insanity didn’t sink in: Buy now, pay later for groceries and gas. Lunacy!

Earlier this year, 27-year old Benjamin Espinoza told NBC News that he uses BNPL to buy food. Using a discount code from Instacart and selecting Klarna at checkout, Espinoza spread out his roughly $40 grocery bill over several payments. “It sucks that these are the avenues that I have to go through,” said the video editor, who lives with three roommates in San Antonio.

The option to pay in installments using short-term loans has been around for several years but exploded in popularity during the pandemic, especially with younger, digitally savvy consumers who gravitated to the services as an alternative to credit cards. However, “BNPL essentially lets people dig a deeper and deeper hole of credit, which will be harder and harder to climb out of,” said Ed deHaan, a professor of accounting at Stanford Graduate School of Business.

Some people argue that BNPL normalizes and even glamorizes debt, promoting the message that owing money is fun, cool, and desirable. Back in 2021, the BBC reported on a social media influencer who had been approached by Klarna to do paid posts on Instagram. When she discovered how much debt the services had been driving amongst younger people, she cancelled the engagement and spoke out about her regret in promoting the service:

If BNPL leading young people into a spiral of debt wasn’t worrying enough, it could also be contributing to the death of the American Dream — the aspiration that fueled Tony Manero throughout Saturday Night Fever.

Many call it financial nihilism: Gen Z is increasingly convinced the world around them is meaningless and have largely given up on the promise of homeownership and financial security. With that bleak outlook, is it any wonder they’re spending like there’s no tomorrow?

I remember as a child, the famous parental saying " DO YOU THINK MONEY GROES ON A TREE " now it groes in a phone , HMMMMM!!!!!!!