America's giant debt hole

Three ways our current looming debt crisis is different from past decades.

Will Rogers’ famous saying — "If you find yourself in a hole, stop digging" — comes to mind when looking at the results of a recent survey about holiday spending.

Just in time for the end of year spend-a-thon that is the holidays in the United States, many Americans are still grappling with the debt they took on a year ago, a new report from CNBC and WalletHub says.

The WalletHub survey revealed the result of an online survey taken by nearly 250 respondents:

Skipping Presents: More than 1 in 3 Americans are foregoing gifts this year due to inflation.

Lingering Holiday Debt: Nearly 1 in 4 Americans still have holiday debt from last year.

New Credit Card: Nearly 1 in 5 people will apply for a new credit card to help with holiday shopping.

Inflation Impacting Charity: Nearly half of Americans say their charitable giving is affected by inflation.

Reduced Holiday Spending: 28% of people will spend less than last year on their holiday shopping.

Social Media Influence: 23% of Americans are planning to make a holiday purchase based on social media.

Imagine if 1 in 3 politicians made the same choice as so many Americans — when faced with debt and a lack of available funds, they opt to cut back on spending, not spend more.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget (CRFB), said it as clear as day: "We are a nation addicted to debt."

And she's not wrong. The whole country — from citizens to the federal government — is in way over its head.

According to the CRFB — a nonpartisan, non-profit organization working to educate the public on fiscal policy issues and their impact — the US deficit totaled $1.7 trillion in fiscal year 2023, which ended 30 September. (In actuality, the country borrowed $2 trillion when accounting for President Biden’s reversed student debt cancellation plan. Year-over-year, the US doubled what it borrowed compared to 2022.)

Already in the first month of fiscal year 2024, the US borrowed $67 billion.

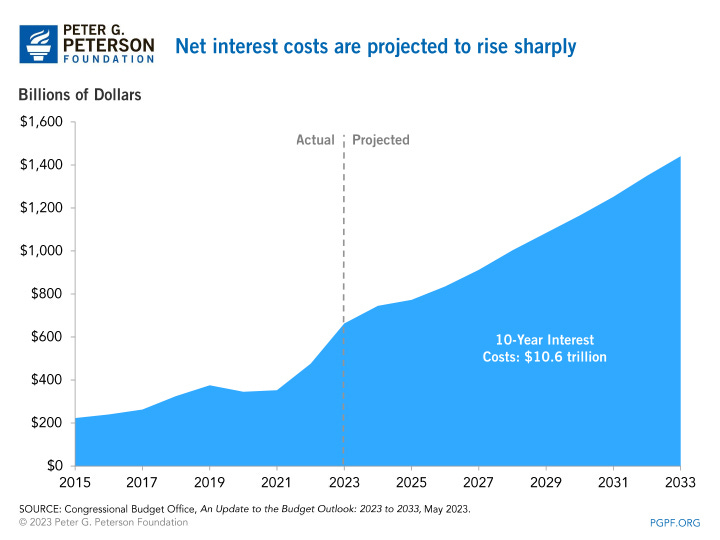

These insurmountable figures not only burden future generations but also constrain the government's ability to maneuver in times of crisis. The CRFB reports that we’re on course to borrow another $19 trillion over the next decade alone, while interest costs are surging past other parts of the budget.

If you’ve been around and paying attention for a while, you may shrug and think, ‘So what, debt has always been a problem and we’re still here.’ Here are three reasons why the situation we now face in the United States is unique:

Interest rates are rising: Huge deficits are only manageable if interest rates are low. As interest rates increase, the federal government is forced to spend more on interest than on budget areas such as veterans’ benefits, transportation, and education. By fiscal year 2028, the Peter G. Peterson Foundation estimates the federal government will spend more on interest than on defense. By 2031, it will spend more on interest than discretionary spending on transportation, veterans, education, health, international affairs, natural resources, environment, and more.

No one wants US Treasury bonds anymore: Once thought of as the safest asset you could own, Treasury bonds are having their worst stretch since the Civil War. China and Japan once held more than 22% of US government bonds; after a massive selloff over the past 10 years that number is now 7%.

You’re not allowed to talk about it: The White House, panicking over poor polling numbers, is enlisting TikTok influencers to “tell positive stories of Biden’s economic stewardship,” according to a recent story in the Washington Post. The Biden administration is also working with social media platforms to counter misinformation about the economy, just as they did with regard to the pandemic.

The above doesn’t even begin to account for the burden of Social Security, which according to the Congressional Budget Office:

…[f]aces a significant financial challenge in the coming decade. Its two components, Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI), are financed by revenues from payroll taxes and income taxes on benefits that are credited to separate trust funds. But those revenues are not sufficient to cover the benefits that are due under those programs.

Just because the American government is spending like a drunken sailor, doesn’t mean you should, too. We recommend tightening your belts for a very bumpy ride ahead.

Don't see any light at the end of any tunnel on this. But... don't mention it. Maybe it'll just go away.